World Bank Cuts China Growth Outlook on COVID-19, Property Woes

BEIJING—The World Bank has cut its China growth outlook for this year and next, citing the impact of the abrupt loosening of strict COVID-19 containment measures and persistent property sector weakness.The Washington-based lender, in a report released on Tuesday, said it expected China’s economy to grow 2.7 percent in 2022, before recovering to 4.3 percent in 2023 as it reopens following the worst of the pandemic. The bank’s expected expansion for 2022 would be well below the official target of around 5.5 percent. In September, the World Bank forecast China’s growth at 2.8 percent this year and 4.5 percent next year. “China’s growth outlook is subject to significant risks, stemming from the uncertain trajectory of the pandemic, of how policies evolve in response to the COVID-19 situation, and the behavioral responses of households and businesses,” the bank said in its report. “Persistent stress in the real estate sector could have wider macroeconomic and financial spillovers.” China also faces highly uncertain global growth prospects and heightened geopolitical tension, the lender said.

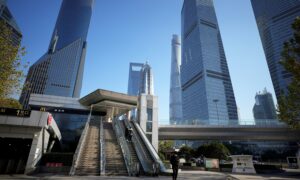

BEIJING—The World Bank has cut its China growth outlook for this year and next, citing the impact of the abrupt loosening of strict COVID-19 containment measures and persistent property sector weakness.

The Washington-based lender, in a report released on Tuesday, said it expected China’s economy to grow 2.7 percent in 2022, before recovering to 4.3 percent in 2023 as it reopens following the worst of the pandemic.

The bank’s expected expansion for 2022 would be well below the official target of around 5.5 percent.

In September, the World Bank forecast China’s growth at 2.8 percent this year and 4.5 percent next year.

“China’s growth outlook is subject to significant risks, stemming from the uncertain trajectory of the pandemic, of how policies evolve in response to the COVID-19 situation, and the behavioral responses of households and businesses,” the bank said in its report.

“Persistent stress in the real estate sector could have wider macroeconomic and financial spillovers.”

China also faces highly uncertain global growth prospects and heightened geopolitical tension, the lender said.