US Debt Default Could Help China Dethrone the Dollar

As the June 5 deadline for a decision on the U.S. debt ceiling looms, China could gain the upper hand in global influence if the United States defaults on its $31.4 trillion debt. Amid political tensions and struggles for trade dominance, the debt ceiling debate is poised to have a significant impact on the U.S. dollar, both in markets and as a global reserve currency. It would be a windfall for China, which aims to dethrone the U.S. dollar as the world’s go-to for trade and cash reserves. The lack of a speedy resolution in Congress and a clear secondary course of action has already shaken investor confidence. In the event of a default, the consequences would be far-reaching for many countries. Though none more so than the United States. A May 3 White House press statement noted, “History is clear that even getting close to a breach of the U.S. debt ceiling could cause significant disruptions to financial markets that would damage the economic conditions faced by households and businesses.” President Joe Biden shakes hands with House Speaker Kevin McCarthy (R-Calif.) before his State of the Union address in February at the U.S. Capitol in Washington, on Feb. 7, 2023. (Jacquelyn Martin/Pool/Getty Images) President Joe Biden and House Speaker Kevin McCarthy reached an “agreement in principle” on May 27, inspiring hope the congressional deadlock over raising the debt ceiling—again—may soon be resolved. “We still have a lot of work to do. But I believe this is an agreement in principle that is worthy of the American people,” McCarthy told reporters. But financial experts and economists are still on the edge of their seats because, as they say, it’s never a done deal until the deal is done. Ripple Effect “If the United States were to fail to pay its debts, it would seriously damage the trust that people and countries have in the U.S. government’s ability to fulfill its financial responsibilities,” Baruch Silvermann told The Epoch Times. Silvermann is a financial expert and CEO of The Smart Investor. He says that, domestically, a default would likely result in a significant economic downturn. “The government would be unable to borrow money to fund its operations, leading to reduced spending and investment. This would cause job losses and a decrease in overall economic activity,” Silvermann said. Like when a penny is thrown into a pond, the ripples in the international community would be even greater. “On a global scale, a U.S. debt default would probably cause the value of the U.S. dollar to decrease. This is because investors would no longer believe that the U.S. government can repay its debts, prompting them to sell dollars and buy other currencies instead,” he said. Silvermann added that it would become more expensive for Americans to purchase imported goods and services, further slowing economic growth. Moreover, investors and central banks holding U.S. dollar assets may seek alternative currencies. Charles Schwab echoed many of these sentiments in a May 26 statement, “While we at Schwab believe that a government default is unlikely, fears around the issue are likely to affect market performance in coming days.” The financial agency said some economic consequences of an actual default could include higher interest rates, impacting consumer and corporate confidence, and triggering a decline in spending. Consequently, people would most likely lose jobs while the country pitches headlong into the chasm of a deeper recession. Amid all this uncertainty is China, expanding its currency reserves and undermining U.S. sovereignty in the West through big-budget trade and investment deals that give the Asian nation greater influence in a growing number of nations. With confidence in the U.S. financial system and government shaken, analysts say it’s a golden opportunity for Beijing. Dollars and Cents Any tarnish on America’s financial reputation can translate into a loss of status and influence on the world stage. This becomes particularly important when Washington uses its most powerful peacetime weapon: sanctions. So if the U.S. dollar takes a hit from a default or ongoing deliberations over the debt ceiling, the use of economic sanctions would be attenuated. With a weaker dollar, China’s vision of expanding the yuan in trade and as a reserve currency comes into focus. This has been a long-time goal of the Chinese Communist Party, which it has taken consistent steps towards for years. By 2015, nearly a quarter of all China’s trade transactions were done in their own currency. Moreover, the list of countries using the yuan as a reserve currency or in trade is growing. Some of these include Russia, Saudi Arabia, Argentina, Brazil, Bangladesh, Pakistan, Iraq, Iran, and Thailand. In Brazil—the second largest democracy in the Americas—the amount of reserve currency in yuan surpassed the euro last year. This makes it second only to the U.S. dollar, according to the nation’s central bank. Brazil’s

As the June 5 deadline for a decision on the U.S. debt ceiling looms, China could gain the upper hand in global influence if the United States defaults on its $31.4 trillion debt. Amid political tensions and struggles for trade dominance, the debt ceiling debate is poised to have a significant impact on the U.S. dollar, both in markets and as a global reserve currency.

It would be a windfall for China, which aims to dethrone the U.S. dollar as the world’s go-to for trade and cash reserves.

The lack of a speedy resolution in Congress and a clear secondary course of action has already shaken investor confidence. In the event of a default, the consequences would be far-reaching for many countries. Though none more so than the United States.

A May 3 White House press statement noted, “History is clear that even getting close to a breach of the U.S. debt ceiling could cause significant disruptions to financial markets that would damage the economic conditions faced by households and businesses.”

President Joe Biden and House Speaker Kevin McCarthy reached an “agreement in principle” on May 27, inspiring hope the congressional deadlock over raising the debt ceiling—again—may soon be resolved.

“We still have a lot of work to do. But I believe this is an agreement in principle that is worthy of the American people,” McCarthy told reporters.

But financial experts and economists are still on the edge of their seats because, as they say, it’s never a done deal until the deal is done.

Ripple Effect

“If the United States were to fail to pay its debts, it would seriously damage the trust that people and countries have in the U.S. government’s ability to fulfill its financial responsibilities,” Baruch Silvermann told The Epoch Times.

Silvermann is a financial expert and CEO of The Smart Investor. He says that, domestically, a default would likely result in a significant economic downturn.

“The government would be unable to borrow money to fund its operations, leading to reduced spending and investment. This would cause job losses and a decrease in overall economic activity,” Silvermann said.

Like when a penny is thrown into a pond, the ripples in the international community would be even greater.

“On a global scale, a U.S. debt default would probably cause the value of the U.S. dollar to decrease. This is because investors would no longer believe that the U.S. government can repay its debts, prompting them to sell dollars and buy other currencies instead,” he said.

Silvermann added that it would become more expensive for Americans to purchase imported goods and services, further slowing economic growth. Moreover, investors and central banks holding U.S. dollar assets may seek alternative currencies.

Charles Schwab echoed many of these sentiments in a May 26 statement, “While we at Schwab believe that a government default is unlikely, fears around the issue are likely to affect market performance in coming days.”

The financial agency said some economic consequences of an actual default could include higher interest rates, impacting consumer and corporate confidence, and triggering a decline in spending. Consequently, people would most likely lose jobs while the country pitches headlong into the chasm of a deeper recession.

Amid all this uncertainty is China, expanding its currency reserves and undermining U.S. sovereignty in the West through big-budget trade and investment deals that give the Asian nation greater influence in a growing number of nations.

With confidence in the U.S. financial system and government shaken, analysts say it’s a golden opportunity for Beijing.

Dollars and Cents

Any tarnish on America’s financial reputation can translate into a loss of status and influence on the world stage. This becomes particularly important when Washington uses its most powerful peacetime weapon: sanctions.

So if the U.S. dollar takes a hit from a default or ongoing deliberations over the debt ceiling, the use of economic sanctions would be attenuated.

With a weaker dollar, China’s vision of expanding the yuan in trade and as a reserve currency comes into focus. This has been a long-time goal of the Chinese Communist Party, which it has taken consistent steps towards for years. By 2015, nearly a quarter of all China’s trade transactions were done in their own currency.

Moreover, the list of countries using the yuan as a reserve currency or in trade is growing. Some of these include Russia, Saudi Arabia, Argentina, Brazil, Bangladesh, Pakistan, Iraq, Iran, and Thailand.

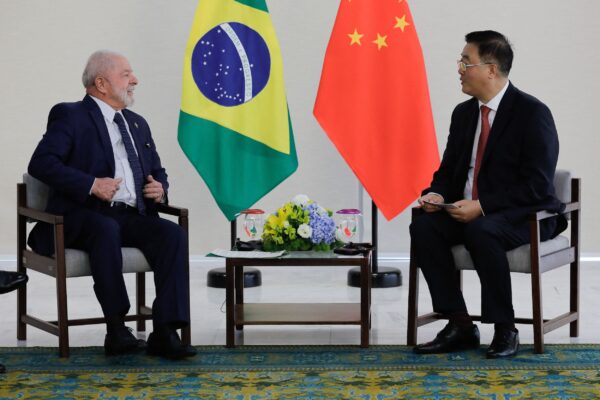

In Brazil—the second largest democracy in the Americas—the amount of reserve currency in yuan surpassed the euro last year. This makes it second only to the U.S. dollar, according to the nation’s central bank.

But Russia is a major driver behind the yuan’s recent surge in global demand this year. Bloomberg Economics reported that Moscow planned to purchase $200 million in Chinese yuan every month starting in May. It’s one of the few remaining currency options since Western sanctions blocked Russia’s access to the dollar-based global financial system.

And while the U.S. dollar still accounts for 60 percent of global currency reserves, analysts say its strength rests on thin ice. Especially now.

“Trust and confidence in America’s ability to honor its financial obligations are essential for the dollar’s widespread acceptance and use in international transactions,” Chris Muller, vice president of Money Under 30, told The Epoch Times.

Muller has spent years working in finance and market analysis. He said a U.S. debt default would erode the credibility of the U.S. Treasury Department’s commitment to repayment.

In the worst-case scenario, he believes it could cause financial markets to contract and steer more nations away from using greenbacks. “It would likely ignite an international crisis with severe implications for the global economy.”

What Goes Around

This isn’t the first time the United States has been up against a deadline to avoid default. The 2011 House agreement to raise the debt ceiling was a buzzer-beater that also imparted a lesson: Government spending needs a reality check.

Over the past 63 years, Congress has raised, revised, or extended the U.S. debt limit 78 times.

But since 2009, government spending has nearly tripled the national debt. This is the crux of the current standoff in Washington, and some Republican legislators say Biden and McCarthy’s agreement doesn’t resolve the underlying problem.

“After this deal, our country will still be careening toward bankruptcy,” Florida governor and Republican 2024 candidate Ron DeSantis said on Fox News.

Currently, a 99-page bill needs to pass the House and Senate. It would suspend the national debt limit through Jan. 1, 2025, and curtail some government spending.

But critics of the bill say it’s not enough. “It’s not a good deal. Some $4 trillion in debt for—at best—a two-year spending freeze and no serious substantive policy reforms,” Rep. Chip Roy (R-Texas) posted on Twitter.

With uncertainty on the horizon and days left until the deadline, some financial analysts say the erosion of U.S. Treasury bonds is another major blow that would come as a result of a debt default. This is another wrench in the proverbial wheel since many central banks, institutional investors, and foreign governments hold substantial quantities of U.S. Treasury bonds in reserves.

“A U.S. debt default would likely trigger significant turmoil in financial markets. Investors rely on U.S. Treasury bonds as a safe haven investment, considering them to be low-risk assets,” Doug Carey told The Epoch Times.

Carey is a Chartered Financial Analyst and the president of Wealth Trace. He predicts a default would drastically erode confidence in the global financial system, prompting investors to demand higher yields on U.S. Treasuries. This could lead to a sharp decline in bond value.

He added, “The U.S. dollar is the world’s primary reserve currency, and a default could weaken its position. A loss of confidence in U.S. debt could lead to a depreciation of the dollar relative to other currencies.”