South Korea’s Top Companies to Attend Economic Forum in Vietnam, Expand Trade

Samsung, SK, Hyundai, and LG see Vietnam as part of an alternative global supply chain to replace China The CEOs of major South Korean conglomerates will attend an economic forum in Vietnam this month as leaders from both countries recently agreed to expand trade and economic cooperation. Analysts say that Vietnam has become a potential manufacturing base for Korean tech giants while China is losing its status as the “world’s factory” amid tensions with the United States. The Korea-Vietnam Economic Forum will be held in Hanoi and is expected to attract Korean business leaders such as Lee Jae-yong, chairman of Samsung Electronics; Chey Tae-won, chairman of SK Group; Chung Eui-sun, chairman of Hyundai Motor Group; Koo Kwang-mo, chairman of LG Group; and Shin Dong-bin, chairman of Lotte Group. The Dong-A Ilbo’s report said in a June 3 report that South Korea and Vietnam will expand bilateral economic cooperation, and major firms of both sides are expected to sign a memorandum of understanding and hold trade-related talks. Tense U.S.-China relations and the restructuring of the global supply chain pave the way for Vietnam to rapidly emerge as the production base and distribution network of Samsung Electronics, Hyundai Motor, LG Electronics, Lotte Group, and other companies, the report said. In a June 4 interview with The Epoch Times, Wang He, a U.S.-based commentator on China’s current affairs, said the United States had imposed several restrictions to counter the Chinese Communist Party (CCP) in the U.S.-China trade war, including high tariffs. “The effect of this [U.S.] strategy [high tariffs against China] had forced Chinese industries and foreign companies to leave China and turn to Vietnam, India, and other countries to avoid taxes, making Vietnam a vital alternative,” he said. Vietnam as a China Alternative According to Wang, many countries are considering the “China Plus One” strategy, which avoids investing only in China and diversifying business operations in other countries such as Vietnam, Indonesia, Thailand, or India. Moving production out of China would be a safe move in the event that cross-strait relations deteriorate or the United States strengthens sanctions against the CCP. “So over the years, Vietnam has become one of the biggest winners of the U.S.-China trade war,” he said. Attendees visit the ETech booth, which advertises a Vietnam factory supply chain promising zero export tariffs, during the Consumer Electronics Show (CES) in Las Vegas, Nevada, on Jan. 6, 2023. (Robyn Beck/AFP via Getty Images) Wang said Vietnam has a lot of potential, and its rich labor resources—a population of 100 million—facilitate growth in various industries, “especially with Samsung investing tens of billions in Vietnam.” “Korean companies see Vietnam as an essential base, in which China’s position as the ‘world’s factory’ has begun to wane,” he said. “China’s status as the ‘world’s factory’ has been shaken as it is caught in a dilemma,” said Wang, noting that European countries are moving away from various Chinese industries, and the United States is cracking down on the Chinese chip industry, hampering Beijing’s plan to transform and upgrade its high-tech industries. The only thing the CCP can rely on now is “industrial scale, industrial chain support, abundant labor force, and complete infrastructure,” but those four strengths are not as effective compared to the ASEAN member countries, India, and other Asian countries, according to Wang. Therefore, China’s economy is worsening and on the verge of great turmoil. “It has become fairly tough to maintain its basic stability, not to mention growth,” Wang said. ‘Vietnam Alone’ Is Not Enough A Vietnamese news outlet said in March that Vietnam has the potential and opportunity to become “the new world’s factory” amid the restructuring of the global supply chain. Wang believes that Vietnam alone cannot replace China in trade. “The West has proposed a concept called ‘Asian supply chain,’ that is, in addition to Vietnam, the entire ASEAN, together with Japan and India, their production capacity, the scale of exports to the United States could be comparable to the exports of mainland China.” Delegates attend the Association of Southeast Asian Nations (ASEAN) Finance Minister’s and Central Bank Governors’s meeting in Nusa Dua on Indonesia’s resort island of Bali on March 31, 2023. (Sonny Tumbelaka/AFP via Getty Images) Asian Supply Chain to Replace China The Economist reported on Feb. 20 that a dozen countries and regions, including Taiwan, are forming an Asian alternative supply chain expected to gradually replace China as the center of global production activities in the coming years. This is the concept of “Altasia” (alternative Asian supply chain), which “stretches in a crescent from Hokkaido, in northern Japan, through South Korea, Taiwan, the Philippines, Indonesia, Singapore, Malaysia, Thailand, Vietnam, Cambodia, and Bangladesh, all

Samsung, SK, Hyundai, and LG see Vietnam as part of an alternative global supply chain to replace China

The CEOs of major South Korean conglomerates will attend an economic forum in Vietnam this month as leaders from both countries recently agreed to expand trade and economic cooperation.

Analysts say that Vietnam has become a potential manufacturing base for Korean tech giants while China is losing its status as the “world’s factory” amid tensions with the United States.

The Korea-Vietnam Economic Forum will be held in Hanoi and is expected to attract Korean business leaders such as Lee Jae-yong, chairman of Samsung Electronics; Chey Tae-won, chairman of SK Group; Chung Eui-sun, chairman of Hyundai Motor Group; Koo Kwang-mo, chairman of LG Group; and Shin Dong-bin, chairman of Lotte Group.

The Dong-A Ilbo’s report said in a June 3 report that South Korea and Vietnam will expand bilateral economic cooperation, and major firms of both sides are expected to sign a memorandum of understanding and hold trade-related talks.

Tense U.S.-China relations and the restructuring of the global supply chain pave the way for Vietnam to rapidly emerge as the production base and distribution network of Samsung Electronics, Hyundai Motor, LG Electronics, Lotte Group, and other companies, the report said.

In a June 4 interview with The Epoch Times, Wang He, a U.S.-based commentator on China’s current affairs, said the United States had imposed several restrictions to counter the Chinese Communist Party (CCP) in the U.S.-China trade war, including high tariffs.

“The effect of this [U.S.] strategy [high tariffs against China] had forced Chinese industries and foreign companies to leave China and turn to Vietnam, India, and other countries to avoid taxes, making Vietnam a vital alternative,” he said.

Vietnam as a China Alternative

According to Wang, many countries are considering the “China Plus One” strategy, which avoids investing only in China and diversifying business operations in other countries such as Vietnam, Indonesia, Thailand, or India. Moving production out of China would be a safe move in the event that cross-strait relations deteriorate or the United States strengthens sanctions against the CCP.

“So over the years, Vietnam has become one of the biggest winners of the U.S.-China trade war,” he said.

Wang said Vietnam has a lot of potential, and its rich labor resources—a population of 100 million—facilitate growth in various industries, “especially with Samsung investing tens of billions in Vietnam.”

“Korean companies see Vietnam as an essential base, in which China’s position as the ‘world’s factory’ has begun to wane,” he said.

“China’s status as the ‘world’s factory’ has been shaken as it is caught in a dilemma,” said Wang, noting that European countries are moving away from various Chinese industries, and the United States is cracking down on the Chinese chip industry, hampering Beijing’s plan to transform and upgrade its high-tech industries.

The only thing the CCP can rely on now is “industrial scale, industrial chain support, abundant labor force, and complete infrastructure,” but those four strengths are not as effective compared to the ASEAN member countries, India, and other Asian countries, according to Wang.

Therefore, China’s economy is worsening and on the verge of great turmoil. “It has become fairly tough to maintain its basic stability, not to mention growth,” Wang said.

‘Vietnam Alone’ Is Not Enough

A Vietnamese news outlet said in March that Vietnam has the potential and opportunity to become “the new world’s factory” amid the restructuring of the global supply chain.

Wang believes that Vietnam alone cannot replace China in trade.

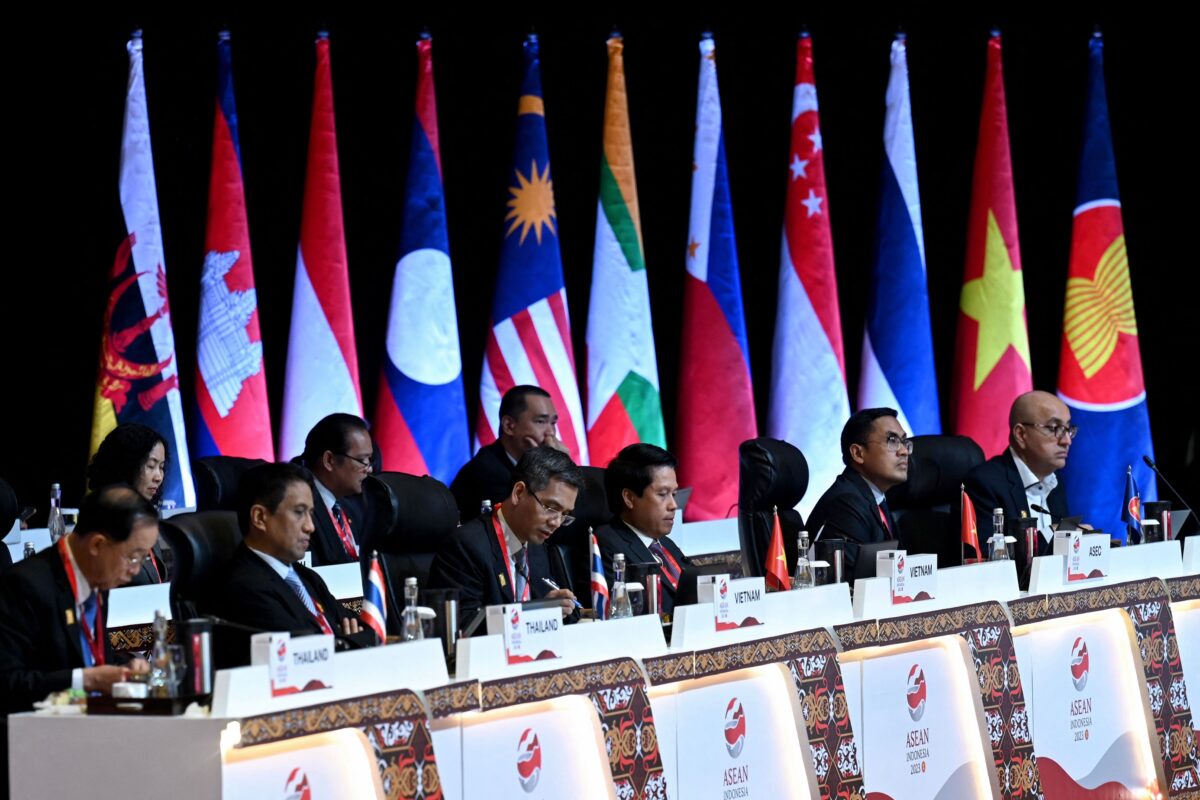

“The West has proposed a concept called ‘Asian supply chain,’ that is, in addition to Vietnam, the entire ASEAN, together with Japan and India, their production capacity, the scale of exports to the United States could be comparable to the exports of mainland China.”

Asian Supply Chain to Replace China

The Economist reported on Feb. 20 that a dozen countries and regions, including Taiwan, are forming an Asian alternative supply chain expected to gradually replace China as the center of global production activities in the coming years.

This is the concept of “Altasia” (alternative Asian supply chain), which “stretches in a crescent from Hokkaido, in northern Japan, through South Korea, Taiwan, the Philippines, Indonesia, Singapore, Malaysia, Thailand, Vietnam, Cambodia, and Bangladesh, all the way to Gujarat, in north-western India.”

“For Altasia to truly rival China, therefore, its supply chain will need to become far more integrated and efficient,” the article reads.

In a March article, The Economist said that the formation of Altasia resulted from the intensifying geopolitical divide between China and the United States.

Although “Chinese production capabilities will be tough to replicate … many companies finding an alternative to China is now a priority. They are likely to be exploring opportunities in Altasia for years to come,” it said.