Push Begins for Even Higher California Taxes

Commentary The (spiked) punchbowl has been removed. The party’s over. The massive budget surpluses of recent years are gone with the Santa Ana winds. Inevitably, in California, that means calls for new tax increases—in the state already suffering the country’s highest taxes. That’s happening as 700,000 people have exited in the last two years due to the state’s high cost of living, including the punishing revenue grabs. The nonpartisan Legislative Analyst just raised by $7 billion its estimated deficit for fiscal year 2023-24, which begins on July 1. Followed by their chart, it found: Due to a deteriorating revenue picture relative to expectations from June 2022, both our office and the administration anticipate the state faces a budget problem in 2023‑24. Although the Governor’s budget revenue estimates are reasonable, they are likely a bit too high. The LAO argued against using the state’s reserve funds to cover the shortfall. Instead, it urged two other major solutions: “the state could shift more costs than the $4.3 billion currently proposed by Governor.” And, “increasing revenues, for example, on a temporary basis to cover the interim shortfalls.” Of course, in California “temporary” tax increases have a tendency to become permanent. Gov. Jerry Brown’s Proposition 30 tax increase of 2012 was sold with this ballot title read by voters, “Temporary Taxes to Fund Education. Guaranteed Local Public Safety Funding. Initiative Constitutional Amendment.” “Temporary” lasted until 2016, when Proposition 55 was passed, extending the income-tax part another 12 years, although the smaller sales-tax part was not included. All this is maneuvering toward the real budgeting business, to be kicked off by Gov. Gavin Newsom’s “May Revise” (to use Sacramento parlance) in 10 weeks. Then it’s a forced march to the June 15 constitutional deadline to pass a budget. However, although the surpluses of recent years have made it easy to pass budgets on time, this year could take us back to the Great Recession years when budget passage was delayed many weeks, even months. In Sept. 2008, Gov. Arnold Schwarzenegger signed the budget 85 days late as the recession dug in and the deficit soared to $42 billion. Shortly after, the next February, he signed a record $13 billion tax increase. This time, the problem is Newsom doesn’t want to damage his presidential chances by being branded a “tax increaser.” But there remain creative ways to pick the taxpayer’s pocket. One is being advanced by the influential California Budget & Policy Center, which never saw a tax increase it didn’t like. In a Feb. 21 email to those on its general list, it urged: But right now, California is losing around $70 billion in state personal and corporate income tax breaks that disproportionately benefit wealthy families and profitable corporations. These dollars could be better invested in other critical public services for Californians like education, health care, child care, and affordable housing. Note how they say the state is “losing” revenue—a socialist idea that all money and capital belongs to “the people,” or “the proletariat,” or “the toiling masses,” to use some old Marxist phrases—but really meaning the government bureaucrats. For them, grabbing your money also means “investing”—in government programs that don’t solve problems and usually make things worse. Why, for example, spend more on education when the amount still is more than $23,000 per year for each K-12 child? Even as California students continue scoring near the bottom on test scores? And get this, the problem is “corporate income tax breaks that disproportionately benefit wealthy families and profitable corporations.” That’s because poor people pay little or no income taxes. So they don’t need “tax breaks.” Do these policy wonks think we’re fools? Apparently. Here’s a screenshot from the Franchise Tax Board’s website. For some exceptions, click on the previous link. So potentially you can make up to $69,524 a year and pay no state income tax. Again, that means you don’t get loopholes—because you don’t need them. I’m reminded of the observation of the great economist Ludwig Mises (teacher of Nobel Laureate Friedrich Hayek), “Capitalism lives through those loopholes.” And another Nobel laureate, Milton Friedman, famously said, “I never met a tax cut I didn’t like.” That obviously includes loopholes. Meanwhile, even more of my middle-class friends are planning to get out of this high-tax state. And today I was emailing with two friends who already left for Idaho. If the California Budget & Policy Center really wants to help the poor, it should stop making so many of them by pushing higher taxes that always hit, and impoverish, the middle class. [Note: The email quoted above isn’t itself online. But the Center just ran a Q&A that’s similar here.] Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.

Commentary

The (spiked) punchbowl has been removed. The party’s over. The massive budget surpluses of recent years are gone with the Santa Ana winds.

Inevitably, in California, that means calls for new tax increases—in the state already suffering the country’s highest taxes. That’s happening as 700,000 people have exited in the last two years due to the state’s high cost of living, including the punishing revenue grabs.

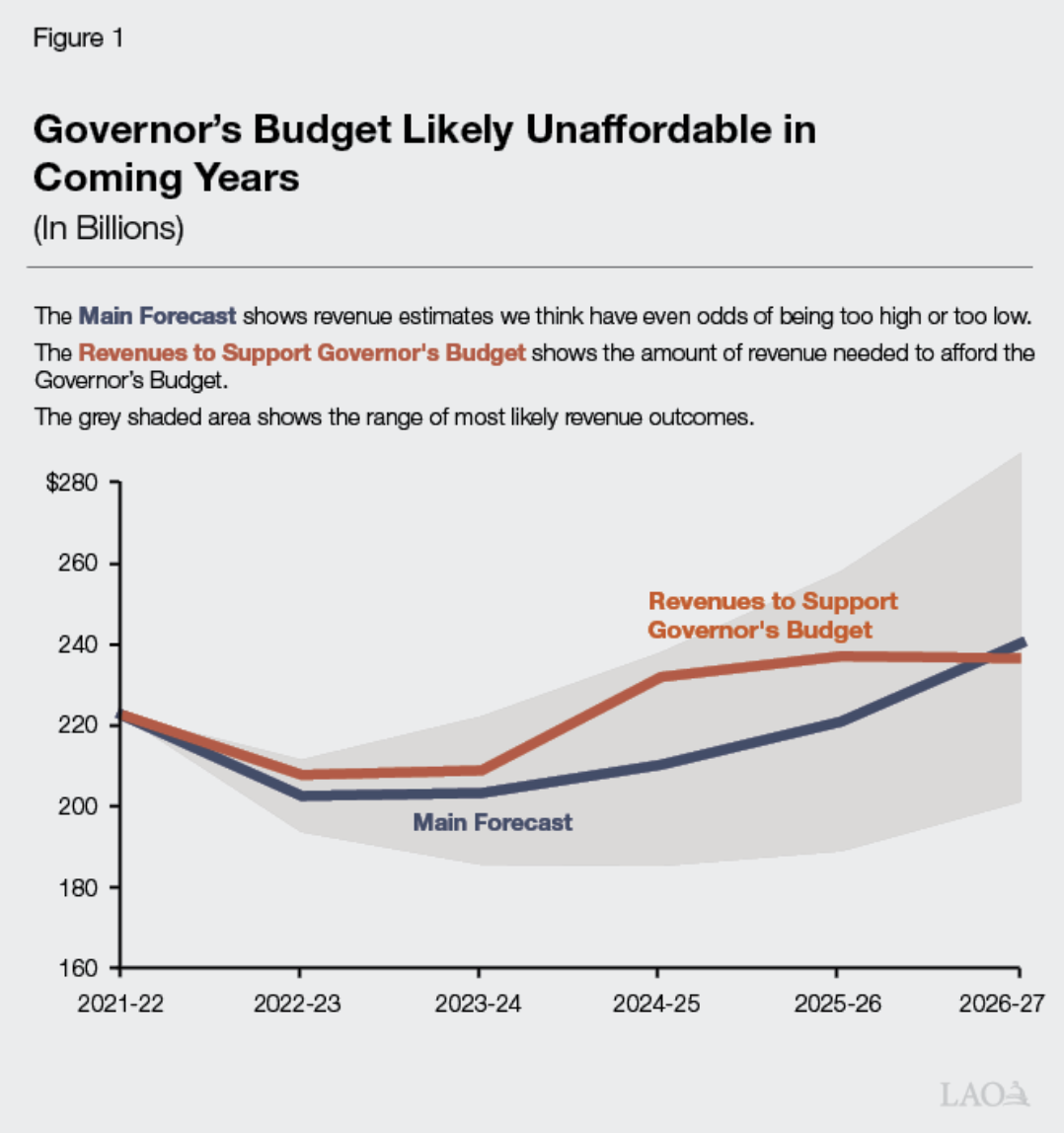

The nonpartisan Legislative Analyst just raised by $7 billion its estimated deficit for fiscal year 2023-24, which begins on July 1. Followed by their chart, it found:

Due to a deteriorating revenue picture relative to expectations from June 2022, both our office and the administration anticipate the state faces a budget problem in 2023‑24. Although the Governor’s budget revenue estimates are reasonable, they are likely a bit too high.

The LAO argued against using the state’s reserve funds to cover the shortfall. Instead, it urged two other major solutions: “the state could shift more costs than the $4.3 billion currently proposed by Governor.” And, “increasing revenues, for example, on a temporary basis to cover the interim shortfalls.”

Of course, in California “temporary” tax increases have a tendency to become permanent. Gov. Jerry Brown’s Proposition 30 tax increase of 2012 was sold with this ballot title read by voters, “Temporary Taxes to Fund Education. Guaranteed Local Public Safety Funding. Initiative Constitutional Amendment.”

“Temporary” lasted until 2016, when Proposition 55 was passed, extending the income-tax part another 12 years, although the smaller sales-tax part was not included.

All this is maneuvering toward the real budgeting business, to be kicked off by Gov. Gavin Newsom’s “May Revise” (to use Sacramento parlance) in 10 weeks. Then it’s a forced march to the June 15 constitutional deadline to pass a budget. However, although the surpluses of recent years have made it easy to pass budgets on time, this year could take us back to the Great Recession years when budget passage was delayed many weeks, even months.

In Sept. 2008, Gov. Arnold Schwarzenegger signed the budget 85 days late as the recession dug in and the deficit soared to $42 billion. Shortly after, the next February, he signed a record $13 billion tax increase.

This time, the problem is Newsom doesn’t want to damage his presidential chances by being branded a “tax increaser.” But there remain creative ways to pick the taxpayer’s pocket.

One is being advanced by the influential California Budget & Policy Center, which never saw a tax increase it didn’t like. In a Feb. 21 email to those on its general list, it urged:

But right now, California is losing around $70 billion in state personal and corporate income tax breaks that disproportionately benefit wealthy families and profitable corporations. These dollars could be better invested in other critical public services for Californians like education, health care, child care, and affordable housing.

Note how they say the state is “losing” revenue—a socialist idea that all money and capital belongs to “the people,” or “the proletariat,” or “the toiling masses,” to use some old Marxist phrases—but really meaning the government bureaucrats. For them, grabbing your money also means “investing”—in government programs that don’t solve problems and usually make things worse. Why, for example, spend more on education when the amount still is more than $23,000 per year for each K-12 child? Even as California students continue scoring near the bottom on test scores?

And get this, the problem is “corporate income tax breaks that disproportionately benefit wealthy families and profitable corporations.” That’s because poor people pay little or no income taxes. So they don’t need “tax breaks.” Do these policy wonks think we’re fools? Apparently.

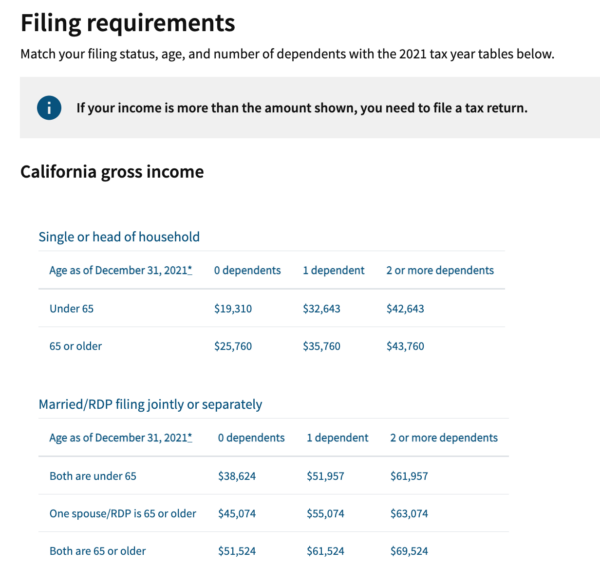

Here’s a screenshot from the Franchise Tax Board’s website. For some exceptions, click on the previous link.

So potentially you can make up to $69,524 a year and pay no state income tax. Again, that means you don’t get loopholes—because you don’t need them.

I’m reminded of the observation of the great economist Ludwig Mises (teacher of Nobel Laureate Friedrich Hayek), “Capitalism lives through those loopholes.”

And another Nobel laureate, Milton Friedman, famously said, “I never met a tax cut I didn’t like.” That obviously includes loopholes.

Meanwhile, even more of my middle-class friends are planning to get out of this high-tax state. And today I was emailing with two friends who already left for Idaho.

If the California Budget & Policy Center really wants to help the poor, it should stop making so many of them by pushing higher taxes that always hit, and impoverish, the middle class.

[Note: The email quoted above isn’t itself online. But the Center just ran a Q&A that’s similar here.]

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.