Investors Worldwide Further Reduce Stakes in Chinese Tech Firms, Some Shift Investment to Taiwan

Analysts: Investors to realize some gains on Chinese stocks before they potentially disappearNew Analysis Amid a grim outlook of the Chinese economy, particularly its technology sector, foreign investors have been cashing out their gains on Chinese stocks, fearing their values might plummet further. Meanwhile, some investors have turned their attention to Taiwanese tech firms. Berkshire Hathaway, Warren Buffett’s investment firm, has reduced its holdings of BYD, a Chinese electric vehicle (EV) conglomerate, six times in less than four months but recently picked up a significant stake in Taiwan Semiconductor Manufacturing Co. (TSMC). According to Hong Kong Stock Exchange (HKEX) data, on Dec. 8, Berkshire Hathaway sold 1,329,500 shares of BYD at an average price of HK$201.3432 per share (about $26 per share), cashing out HK$267.7 million (about $34.4 million). In less than four months, Berkshire Hathaway has sold a quarter of its shares in BYD. Buffett bought 225 million shares of BYD for $232 million in 2008 and had never sold or reduced his holdings in the past 14 years. Recently, the company’s stock price has multiplied as much as 33 times, with its market cap reaching as high as $7.7 billion. However, Buffett has offloaded his BYD shares six consecutive times on Aug. 24, Sept. 1, Nov. 1, Nov. 8, Nov. 17, and Dec. 8. Berkshire Hathaway’s current stake in BYD has been reduced from 20.04 percent in August to 14.97 percent. An electric concept car from Chinese vehicle manufacturer BYD was displayed at the Beijing auto show on April 26, 2018. (Wang Zhao/AFP via Getty Images) Presently, it is not clear why Buffett reduced his shareholding in BYD. However, just a week before Buffett first reduced his shareholding in BYD, on Aug. 16, U.S. President Joe Biden signed the Inflation Reduction Act (IRA) into law. The Act stipulates that electric vehicles must contain a battery built with minerals mined or recycled in North America to qualify for the federal tax credit. And that, by 2024, at least 50 percent of EV batteries must come from the United States, Canada, or Mexico, with that figure rising to 100 percent by 2028. These rules are believed to be aimed at curbing China’s electric vehicle supply chain. According to the International Energy Agency (IEA), Chinese companies currently hold more than half of the processing and refining capacity of lithium, cobalt, and graphite—critical components for EV batteries. The bill is considered a massive blow to Chinese electric vehicle and battery companies. According to Bloomberg, under the effect of the IRA, Stella Li, executive vice president of BYD, said on Dec. 6 that the company currently does not plan to sell electric vehicles in the United States. However, BYD is still looking to build a battery factory in the United States, said the top executive. Li also called the IRA’s requirement to source raw materials from countries with free trade agreements with the United States “confusing,” which will inevitably marginalize Chinese companies. In addition, BYD’s photovoltaic business is also facing trouble. A solar panel is integrated into Chinese automaker BYD’s F3BD, a hybrid vehicle, at the company’s display at the North American International Auto Show in Detroit, Michigan, Jan. 10, 2011. (Geoff Robins/AFP via Getty Images) Chinese Solar Makers Under Tariff-Evasion Investigation On Dec. 2, the U.S. Department of Commerce announced preliminary determinations on four Chinese solar cell makers in a tariff evasion investigation. The preliminary probe found that four out of eight Chinese solar companies under investigation, including BYD Hong Kong, were sending photovoltaic modules to Southeast Asian countries, such as Malaysia, Thailand, Vietnam, or Cambodia, for minor processing before exporting them to the United States in order to avoid U.S. tariffs. Although the Biden administration announced in June this year that it would exempt import duties on solar cells and components from the four aforementioned Southeast Asian countries for two years, BYD’s circumventing move on U.S. tariffs is widely expected to impact the company’s subsequent development. It is unclear whether Buffett will continue to reduce his stake in BYD. However, while reducing his holdings of BYD, Buffett turned his attention to TSMC, the world’s largest and most advanced chip manufacturer, which produces more than 90 percent of the world’s high-end chips. On Nov. 14, Berkshire Hathaway disclosed that it had purchased more than $4.1 billion of stock in TSMC. In documents submitted to U.S. regulators, Berkshire Hathaway acquired more than 60 million American depositary shares (ADRs) from TSMC in the three months to the end of September this year. A logo of Taiwan Semiconductor Manufacturing Co. (TSMC) at its headquarters in Hsinchu, Taiwan, on Aug. 31, 2018. (Tyrone Siu/Reuters) Taiwan’s Foxconn Drops Tsinghua Unigroup On Dec. 16, Taiwan’s Foxconn Group disclosed that its s

Analysts: Investors to realize some gains on Chinese stocks before they potentially disappear

New Analysis

Amid a grim outlook of the Chinese economy, particularly its technology sector, foreign investors have been cashing out their gains on Chinese stocks, fearing their values might plummet further. Meanwhile, some investors have turned their attention to Taiwanese tech firms.

Berkshire Hathaway, Warren Buffett’s investment firm, has reduced its holdings of BYD, a Chinese electric vehicle (EV) conglomerate, six times in less than four months but recently picked up a significant stake in Taiwan Semiconductor Manufacturing Co. (TSMC).

According to Hong Kong Stock Exchange (HKEX) data, on Dec. 8, Berkshire Hathaway sold 1,329,500 shares of BYD at an average price of HK$201.3432 per share (about $26 per share), cashing out HK$267.7 million (about $34.4 million).

In less than four months, Berkshire Hathaway has sold a quarter of its shares in BYD.

Buffett bought 225 million shares of BYD for $232 million in 2008 and had never sold or reduced his holdings in the past 14 years. Recently, the company’s stock price has multiplied as much as 33 times, with its market cap reaching as high as $7.7 billion.

However, Buffett has offloaded his BYD shares six consecutive times on Aug. 24, Sept. 1, Nov. 1, Nov. 8, Nov. 17, and Dec. 8.

Berkshire Hathaway’s current stake in BYD has been reduced from 20.04 percent in August to 14.97 percent.

Presently, it is not clear why Buffett reduced his shareholding in BYD. However, just a week before Buffett first reduced his shareholding in BYD, on Aug. 16, U.S. President Joe Biden signed the Inflation Reduction Act (IRA) into law.

The Act stipulates that electric vehicles must contain a battery built with minerals mined or recycled in North America to qualify for the federal tax credit. And that, by 2024, at least 50 percent of EV batteries must come from the United States, Canada, or Mexico, with that figure rising to 100 percent by 2028.

These rules are believed to be aimed at curbing China’s electric vehicle supply chain. According to the International Energy Agency (IEA), Chinese companies currently hold more than half of the processing and refining capacity of lithium, cobalt, and graphite—critical components for EV batteries.

The bill is considered a massive blow to Chinese electric vehicle and battery companies.

According to Bloomberg, under the effect of the IRA, Stella Li, executive vice president of BYD, said on Dec. 6 that the company currently does not plan to sell electric vehicles in the United States.

However, BYD is still looking to build a battery factory in the United States, said the top executive.

Li also called the IRA’s requirement to source raw materials from countries with free trade agreements with the United States “confusing,” which will inevitably marginalize Chinese companies.

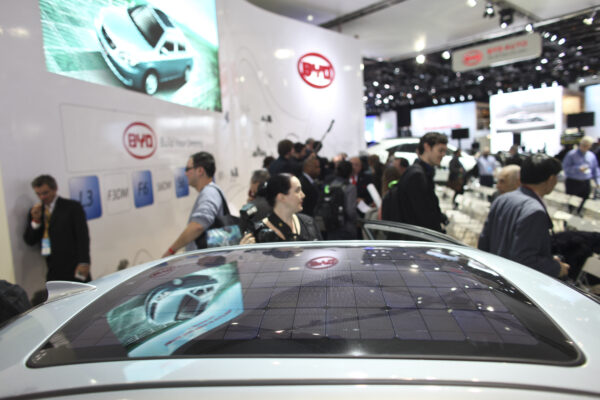

In addition, BYD’s photovoltaic business is also facing trouble.

Chinese Solar Makers Under Tariff-Evasion Investigation

On Dec. 2, the U.S. Department of Commerce announced preliminary determinations on four Chinese solar cell makers in a tariff evasion investigation.

The preliminary probe found that four out of eight Chinese solar companies under investigation, including BYD Hong Kong, were sending photovoltaic modules to Southeast Asian countries, such as Malaysia, Thailand, Vietnam, or Cambodia, for minor processing before exporting them to the United States in order to avoid U.S. tariffs.

Although the Biden administration announced in June this year that it would exempt import duties on solar cells and components from the four aforementioned Southeast Asian countries for two years, BYD’s circumventing move on U.S. tariffs is widely expected to impact the company’s subsequent development.

It is unclear whether Buffett will continue to reduce his stake in BYD. However, while reducing his holdings of BYD, Buffett turned his attention to TSMC, the world’s largest and most advanced chip manufacturer, which produces more than 90 percent of the world’s high-end chips.

On Nov. 14, Berkshire Hathaway disclosed that it had purchased more than $4.1 billion of stock in TSMC.

In documents submitted to U.S. regulators, Berkshire Hathaway acquired more than 60 million American depositary shares (ADRs) from TSMC in the three months to the end of September this year.

Taiwan’s Foxconn Drops Tsinghua Unigroup

On Dec. 16, Taiwan’s Foxconn Group disclosed that its subsidiary Foxconn Industrial Internet would sell all of its shares in China’s Tsinghua Unigroup to Yantai Haixiu IC Investment Center.

After five months of acquiring it, Foxconn had decided to offload all of its shares of Tsinghua Unigroup, China’s largest chipmaker.

In a separate statement, Foxconn said the company’s move was to avoid uncertainty as the investment has yet to be finalized.

On July 14, Foxconn Industrial Internet indirectly acquired a nearly 10 percent stake in Tsinghua Unigroup. However, the move to invest in the Chinese state-owned enterprise sparked a review from the Taiwanese government.

Tsinghua Unigroup is a critical semiconductor company in China. One of its major investments, Chinese memory chipmaker Yangtze Memory Technologies (YMTC), was among 35 Chinese companies added to the U.S. Entity List, according to the U.S. Commerce Department on Dec. 15.

The recent addition of major Chinese chip players to the trade blacklist is believed to have broadened the U.S. crackdown on China’s chip industry.

On Oct. 7, the U.S. Commerce Department unveiled sweeping new export controls aimed at hamstringing the military modernization of an increasingly hostile Chinese regime.

Among the new export rules is a measure that will cut communist China off from cutting-edge chipmaking equipment and certain advanced semiconductor chips made with U.S. technologies, regardless of whether the chips were manufactured in the United States.

Tsinghua Unigroup fell into a debt crisis at the end of 2020. In July last year, the company disclosed that one of its creditors had requested the court to initiate bankruptcy and reorganization proceedings due to the group’s failure to repay debts and its glaring insolvency.

Stakes in two other Chinese tech giants—Alibaba and Tencent—have also been heavily sold off this year.

Share prices of Tencent and Alibaba continued to plummet amid Beijing’s heavy regulatory crackdown on Chinese tech companies, triggered by ride-hailing giant Didi entering the New York Stock Exchange (NYSE) in July last year.

On Dec. 16, the Hong Kong Stock Exchange (HKEX) disclosed that Tencent’s largest shareholder, South African media group Naspers, once again reduced its holdings of 993,000 Tencent shares on Dec. 13.

Naspers, a South African internet and media group, acquired a 45.6 percent stake in Tencent in 2001. On June 27 this year, Naspers announced a plan to reduce its holdings of Tencent indefinitely, which caused panic in the market.

Tencent’s stock price on the HKEX has fallen nearly 60 percent from its February 2021 high.

On Aug. 10, Japan’s Softbank Group announced that the company’s board of directors approved a significant reduction in its holdings in Alibaba before the end of September this year.

The company sold 242 million American depositary receipts (ADRs) of Alibaba, reducing its stake in the company from 23.7 percent to 14.6 percent.

SoftBank Group invested $20 million in Alibaba in 2000, which has long been considered one of the most successful investment decisions the company has ever made. The bet was worth $60 billion when Alibaba went public in 2014.

However, in the fourth quarter of 2021, SoftBank started selling a small amount of stake in Alibaba. And this year’s significant reduction has greatly reduced the company’s reliance on Chinese investment.

Alibaba’s market value has fallen by two-thirds from its October 2020 high.

The outlook for Chinese technology companies has dimmed in recent years. Wall Street analysts believe investors such as Berkshire Hathaway, Naspers, and Softbank “want to realize some of their massive gains on Chinese stocks before they potentially disappear,” according to Business Insider.