For China, Default Is the Only Way Out

The China debt crisis led by the real estate bubble burst will be unprecedented. Even a single major developer could have a trillion Yuan (US$145 billion) debt; the overall total will be a mystery. Yet, we can still have a very vague idea about how significant the debt is by doing some basic arithmetic. Life will be much simpler if we assume all problems originate from excess properties. Based on a 2018 report from the Survey and Research Center for China Household Finance of Southwestern University of Finance and Economics, there were 130 million vacant flats.From real estate agent’s figures, the median housing price across cities is likely 20 to 30 thousand Yuan per square metre. Let’s take the lower end. Further, assuming a flat size of 50 square metres (or 545 square feet), each flat should be worth 1 million Yuan (US$145,000). A total of 130 million excessive apartments should be worth 130 trillion Yuan (US$18.85 trillion). The above flat vacancy was estimated based on a vacancy rate of 21.4 percent, where 5-10 percent is internationally regarded as usual, and 10 percent plus is regarded as dangerous. This means at least 11.4 percent of the above vacancy rate is dangerous. Transforming to the total flats’ value, this is 69 trillion Yuan (130÷21.4×11.4), or roughly US$10 trillion (using an exchange rate of 6.9). This amount bubbled up over the years and should go to zero after full deleveraging. What concept is US$10 trillion, an astronomical number to most people? Look at the accompanying chart with the total debt issuance series in black—the total outstanding at the end—of 2021 was US$21.8 trillion. If 10 trillion has to be wiped out, the ultimate default rate could be as high as 40-50 percent, counting only real estate defaults. By comparing the total debt with those held by central government, local government and external parties, one can see such US$10 trillion potential bad debt should be largely raised by private sector, given the outstanding by government is less than this total. The recent rescue plan was about raising only up to 0.3 trillion Yuan or US$0.04 trillion, with the People’s Bank of China (PBoC) contributing at most 10 percent of this, i.e., US$0.4 billion. This is nothing but a joke. The message is clear: The green light of massive default is on. Why do they let the too big to fail, fail? Because they know there is really no way out. Even exhausting the US$3 trillion foreign exchange reserves, there is still a US$7 trillion shortfall. China’s latest (May) monetary base stood at 32.5 trillion Yuan or US$4.8 trillion. This means PBoC needs to print 1.5 times the existing monetary base to fill the gap. The Fed nearly did this before in 2008 by doubling its monetary base. Yet US$ is an international currency. The result of Yuan following suit will be highly uncertain. Seriously, there is really no way out. Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times. Follow Law Ka-chung is a commentator on global macroeconomics and markets. He has been writing numerous newspaper and magazine columns and talking about markets on various TV, radio, and online channels in Hong Kong since 2005. He covers all types of economics and finance topics in the United States, Europe, and Asia, ranging from macroeconomic theories to market outlook for equities, currencies, rates, yields, and commodities. He has been the chief economist and strategist at a Hong Kong branch of the fifth-largest Chinese bank for more than 12 years. He has a Ph.D. in Economics, MSc in Mathematics, and MSc in Astrophysics. Email: [email protected]

The China debt crisis led by the real estate bubble burst will be unprecedented. Even a single major developer could have a trillion Yuan (US$145 billion) debt; the overall total will be a mystery. Yet, we can still have a very vague idea about how significant the debt is by doing some basic arithmetic. Life will be much simpler if we assume all problems originate from excess properties. Based on a 2018 report from the Survey and Research Center for China Household Finance of Southwestern University of Finance and Economics, there were 130 million vacant flats.

From real estate agent’s figures, the median housing price across cities is likely 20 to 30 thousand Yuan per square metre. Let’s take the lower end. Further, assuming a flat size of 50 square metres (or 545 square feet), each flat should be worth 1 million Yuan (US$145,000). A total of 130 million excessive apartments should be worth 130 trillion Yuan (US$18.85 trillion). The above flat vacancy was estimated based on a vacancy rate of 21.4 percent, where 5-10 percent is internationally regarded as usual, and 10 percent plus is regarded as dangerous. This means at least 11.4 percent of the above vacancy rate is dangerous.

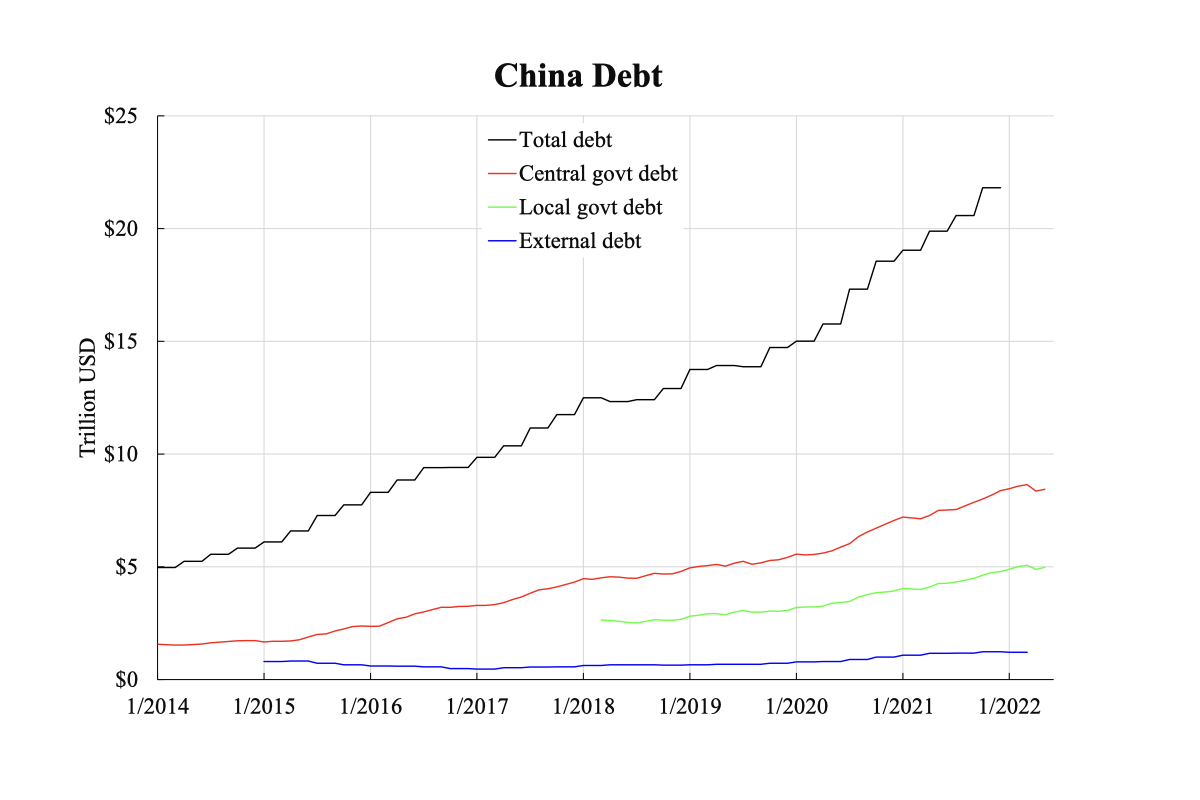

Transforming to the total flats’ value, this is 69 trillion Yuan (130÷21.4×11.4), or roughly US$10 trillion (using an exchange rate of 6.9). This amount bubbled up over the years and should go to zero after full deleveraging. What concept is US$10 trillion, an astronomical number to most people? Look at the accompanying chart with the total debt issuance series in black—the total outstanding at the end—of 2021 was US$21.8 trillion. If 10 trillion has to be wiped out, the ultimate default rate could be as high as 40-50 percent, counting only real estate defaults.

By comparing the total debt with those held by central government, local government and external parties, one can see such US$10 trillion potential bad debt should be largely raised by private sector, given the outstanding by government is less than this total. The recent rescue plan was about raising only up to 0.3 trillion Yuan or US$0.04 trillion, with the People’s Bank of China (PBoC) contributing at most 10 percent of this, i.e., US$0.4 billion. This is nothing but a joke. The message is clear: The green light of massive default is on.

By comparing the total debt with those held by central government, local government and external parties, one can see such US$10 trillion potential bad debt should be largely raised by private sector, given the outstanding by government is less than this total. The recent rescue plan was about raising only up to 0.3 trillion Yuan or US$0.04 trillion, with the People’s Bank of China (PBoC) contributing at most 10 percent of this, i.e., US$0.4 billion. This is nothing but a joke. The message is clear: The green light of massive default is on.

Why do they let the too big to fail, fail? Because they know there is really no way out. Even exhausting the US$3 trillion foreign exchange reserves, there is still a US$7 trillion shortfall. China’s latest (May) monetary base stood at 32.5 trillion Yuan or US$4.8 trillion. This means PBoC needs to print 1.5 times the existing monetary base to fill the gap. The Fed nearly did this before in 2008 by doubling its monetary base. Yet US$ is an international currency. The result of Yuan following suit will be highly uncertain.

Seriously, there is really no way out.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.