Chinese Billionaire Who Purchased Texas Land Failed to Report Foreign Land Ownership, Received Lowered Fine

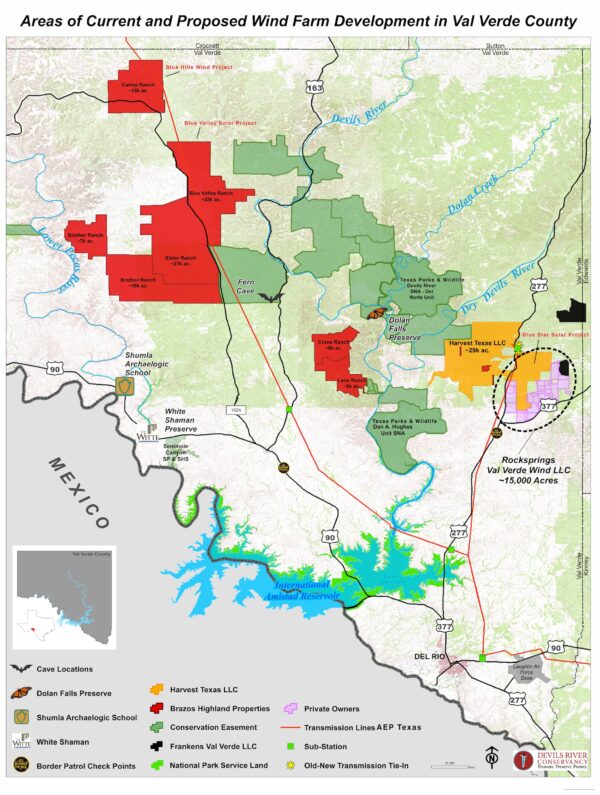

A Chinese billionaire purchased about 140,000 acres of agricultural land in Val Verde County, Texas, since 2016, and planned to build Blue Hills Wind Farm on this property near the U.S.-Mexico border and the Laughlin Air Force Base, a training ground for military pilots.The proposed wind project would have allowed the Chinese owner access to Texas’s electricity grid, and when the community took note, it raised national security concerns. Billionaire Sun Guangxin is a former officer of the People’s Liberation Army (PLA)—the military of the Chinese Communist Party (CCP)—and a self-made businessman in the Xinjiang region in China, an area now the site of an ongoing repression of Uyghurs. “We have been and will continue to be driven by the principle of keeping the Party in mind and obeying the Party’s commands,” says the official website of Xinjiang Guanghui Industry Investment Group Co. Ltd. (Guanghui), a company founded by Sun. Guanghui also vows to “take Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era as its guide,” referring to the personal dogma of the CCP’s leader. Brazos Highland Properties LP (Brazos), the entity Sun used to purchase the land in Val Verde County, didn’t report the foreign ownership to the U.S. Department of Agriculture (USDA). In April 2021, the fee was settled at about $120,000 from $21 million, the maximum fine amount according to the Agricultural Foreign Investment Disclosure Act (AFIDA) of 1978. AFIDA requires a foreign person to disclose any acquisition or disposal of an interest in U.S. agricultural land. The foreign persons must submit filings to the Farm Service Agency (FSA) within 90 days of the date of the transaction. Failure to report is subject to a civil penalty of one-tenth of one percent (0.1%) of the land’s fair market value for each week the AFIDA report was filed late, up to 25 percent. In the April 2021 letter to Brazos, USDA said Brazos’s filings for multiple transactions were 8,017 days late on an aggregated level. Hence, the maximum amount of 25 percent would apply. However, according to the letter, downward adjustments were provided based on the duration of the violation, the method of discovery of the breach, and “extenuating circumstances concerning the violation.” The letter did not detail what these extenuating circumstances were. “Accordingly, based on the above downward adjustments, the civil penalty assessed against the Company has been lowered from $21,060,689.29 to $120,216.38,” the letter continued. According to the USDA data obtained under the Freedom of Information Act (FOIA) by trade publication Agri-Pulse (pdf), the $120,000 fine to Brazos was the highest amount charged to any violators to date. The payment was remitted in July 2021. “Brazos provided extensive documentation showing that its late filing of its AFIDA reports was essentially a good faith error that was corrected very quickly once the company became aware of it,” Kenneth Ackerman, a lawyer and former USDA official who represented Brazos in its discussions with the agency, told The Epoch Times in an email. The USDA did not return a request for comment. Fines Decreased as Foreign Purchases Increased According to USDA (pdf), foreign investors held about 38 million acres of U.S. agricultural land as of Dec. 31, 2020, representing an increase of over 2.4 million acres from the end of 2019. The annual growth was about 0.8 million acres on average between 2009 and 2015, and 2.2 million since 2015. Meanwhile, the reporting penalties imposed by USDA declined in general. From 2000 to 2011, the agency reported $870,000 in fines against 331 investors, and a fine of $245,818 out of eight penalties from 2012 to July 2021. Among the eight penalties, only three have been imposed since 2015, including the fine to Brazos and Harvest Texas, LLC, Sun’s private ranch. The fine drop during the surge of foreign purchases of U.S. agricultural land was probably due to a combination of more compliance in reporting and a shift in USDA’s priorities, according to a USDA official who spoke to Agri-Pulse on condition of anonymity. He added that the agency believed large penalties could disincentivize filing. A map of the 140,000-acre agricultural land Chinese billionaire Sun Guangxin acquired in Val Verde County, Texas, and the locations of its three energy generation projects: Blue Hills Wind, Blue Star Solar, and Blue Valley Solar. (Courtesy of the Devils River Conservancy) Blue Hills Wind Farm The Committee on Foreign Investment in the United States (CFIUS) cleared Sun’s wind farm project on condition of mitigation agreements, which were reached with the Department of Defense in July 2021. However, the project was halted by a new Texas law that came into effect in June 2021. The Lone Star Infrastructure Protection Act (LIPA) bans Texas businesses and governments from doing business with foreign entities from China, Russia, North Korea, and Iran if these transactions wo

A Chinese billionaire purchased about 140,000 acres of agricultural land in Val Verde County, Texas, since 2016, and planned to build Blue Hills Wind Farm on this property near the U.S.-Mexico border and the Laughlin Air Force Base, a training ground for military pilots.

The proposed wind project would have allowed the Chinese owner access to Texas’s electricity grid, and when the community took note, it raised national security concerns. Billionaire Sun Guangxin is a former officer of the People’s Liberation Army (PLA)—the military of the Chinese Communist Party (CCP)—and a self-made businessman in the Xinjiang region in China, an area now the site of an ongoing repression of Uyghurs.

“We have been and will continue to be driven by the principle of keeping the Party in mind and obeying the Party’s commands,” says the official website of Xinjiang Guanghui Industry Investment Group Co. Ltd. (Guanghui), a company founded by Sun. Guanghui also vows to “take Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era as its guide,” referring to the personal dogma of the CCP’s leader.

Brazos Highland Properties LP (Brazos), the entity Sun used to purchase the land in Val Verde County, didn’t report the foreign ownership to the U.S. Department of Agriculture (USDA). In April 2021, the fee was settled at about $120,000 from $21 million, the maximum fine amount according to the Agricultural Foreign Investment Disclosure Act (AFIDA) of 1978.

AFIDA requires a foreign person to disclose any acquisition or disposal of an interest in U.S. agricultural land. The foreign persons must submit filings to the Farm Service Agency (FSA) within 90 days of the date of the transaction. Failure to report is subject to a civil penalty of one-tenth of one percent (0.1%) of the land’s fair market value for each week the AFIDA report was filed late, up to 25 percent.

In the April 2021 letter to Brazos, USDA said Brazos’s filings for multiple transactions were 8,017 days late on an aggregated level. Hence, the maximum amount of 25 percent would apply. However, according to the letter, downward adjustments were provided based on the duration of the violation, the method of discovery of the breach, and “extenuating circumstances concerning the violation.” The letter did not detail what these extenuating circumstances were.

“Accordingly, based on the above downward adjustments, the civil penalty assessed against the Company has been lowered from $21,060,689.29 to $120,216.38,” the letter continued.

According to the USDA data obtained under the Freedom of Information Act (FOIA) by trade publication Agri-Pulse (pdf), the $120,000 fine to Brazos was the highest amount charged to any violators to date. The payment was remitted in July 2021.

“Brazos provided extensive documentation showing that its late filing of its AFIDA reports was essentially a good faith error that was corrected very quickly once the company became aware of it,” Kenneth Ackerman, a lawyer and former USDA official who represented Brazos in its discussions with the agency, told The Epoch Times in an email.

The USDA did not return a request for comment.

Fines Decreased as Foreign Purchases Increased

According to USDA (pdf), foreign investors held about 38 million acres of U.S. agricultural land as of Dec. 31, 2020, representing an increase of over 2.4 million acres from the end of 2019. The annual growth was about 0.8 million acres on average between 2009 and 2015, and 2.2 million since 2015.

Meanwhile, the reporting penalties imposed by USDA declined in general. From 2000 to 2011, the agency reported $870,000 in fines against 331 investors, and a fine of $245,818 out of eight penalties from 2012 to July 2021. Among the eight penalties, only three have been imposed since 2015, including the fine to Brazos and Harvest Texas, LLC, Sun’s private ranch.

The fine drop during the surge of foreign purchases of U.S. agricultural land was probably due to a combination of more compliance in reporting and a shift in USDA’s priorities, according to a USDA official who spoke to Agri-Pulse on condition of anonymity. He added that the agency believed large penalties could disincentivize filing.

Blue Hills Wind Farm

The Committee on Foreign Investment in the United States (CFIUS) cleared Sun’s wind farm project on condition of mitigation agreements, which were reached with the Department of Defense in July 2021.

However, the project was halted by a new Texas law that came into effect in June 2021. The Lone Star Infrastructure Protection Act (LIPA) bans Texas businesses and governments from doing business with foreign entities from China, Russia, North Korea, and Iran if these transactions would provide the foreign enterprises remote access or control of critical infrastructure.

Afterward, GH America Energy, LLC—a subsidiary of Sun’s GH America Investments Group in the United States—sought various business deals to continue the development. On the purchased land, three energy generation projects—Blue Hills Wind, Blue Star Solar, and Blue Valley Solar— have been registered with the Texas grid operator Electric Reliability Council of Texas (ERCOT).

Blue Hills Wind project under GH America Energy became officially inactive in August, according to ERCOT records. In August, GH America Energy canceled the Blue Star Solar project. The Blue Valley Solar project by Blue Valley Solar, LLC is still ongoing, with an estimated completion date in December 2025.