California Legislative Analyst Discovers ‘Seiler’s Law’ on Budget Spending Limit

Commentary Back in 2003, I was perusing some state budget documents and found an interesting correlation. When state general-fund spending rose above 6.2 percent of the income of Californians, inevitably the state would run deficits, get into budget trouble, and end up having to make sharp budget cuts and tax increases. The data came from Gov. Gray Davis’s January 2003 budget proposal. That’s still how it’s done in Gov. Gavin Newsom’s January 2023 budget proposal, with Schedule 6. Divide the Expenditures/General Fund number by the Expenditures per $100 of Personal Income/General Fund number. The title of my column in the Orange County Register was “The 6.2 percent solution.” Our great artist Jocelyn Leger drew a nice graph. (The column used to be online, but for some reason no longer is.) The name was a play on Sherlock Holmes’ 7 percent solution of cocaine he was addicted to, and for which he was cured by Sigmund Freud in the 1976 movie, “The Seven-Per-Cent Solution.” I noted how it was like carrying a burden on your back. If it’s 10 pounds, then for a healthy person it’s no problem. But 20 pounds for many people is pushing it. Put on 50 pounds and you’re slowed down sharply, and many people might not be able to walk more than a few feet before resting, even falling. A spending burden of 6.2 percent or below is tolerable in California. Above it causes problems. Over the years, I have updated the discovery in different publications. One was on May 27, 2010 in CalWatchDog.com, titled “CA budget tops sensible limits.” It ran this Excel graph, unfortunately not as elegant as Jocelyn’s. I’m a word and numbers guy, not an artist. As I noted in that 2010 column: In early 2005, Tom Campbell, then the budget director for Gov. Schwarzenegger … visited us for an editorial board meeting. I showed him the graph. “That’s Seiler’s Law,” Campbell said. “Like Moore’s Law in computing.” And I’ve kept the name ever since. Well, flash forward to 2023, and I was perusing another budget document—I know, it’s an exciting life—“The 2023–24 Budget Multiyear Assessment,” by the California Legislative Analyst (LAO). Lo and behold, I noticed a graph that looked familiar: Here’s the LAO’s analysis: Even With Revenue Declines, Spending Remains Above Historically Recent Peaks. Since around 2020, the state has seen historic surges in revenues—and ensuing historically large surpluses and spending levels. However, while revenues are moderating from the recent peak, they are still above average historical levels. For example, even after adjusting for inflation, anticipated revenues for 202324 remain about 20 percent higher than before the pandemic. Moreover, the Governor’s proposed spending level—as a share of the economy shown in Figure 3—remains above peaks from the early and mid2000s. None of these levels—both on the revenue and spending side—are consistent with shortfalls seen during recessions. They didn’t mention the 6.2 percent limit—Seiler’s Law. But you can see it anyway if you mentally draw a line across the data points at 6.2 percent, as I did in my graph. They also didn’t mention my discovery. Perhaps they didn’t know about it and figured it out on their own, much as Newton and Leibnitz discovered calculus independently. The Legislative Analyst didn’t provide a detailed analysis. You can read mine in that 2010 article on what happened up to that point. Basically, as you can see from the graphs, the budget went above the 6.2 percent limit in the early 1990s under Republican Gov. Pete Wilson, during the 1999–2000 dot-com boom under Democratic Gov. Gray Davis, then under the wild spending under Republican Gov. Arnold Schwarzenegger in the mid-2000s. Even though he was elected to tame the deficits, and pledged in his January 2004 State of the State address, “Every governor proposes moving boxes around to reorganize government. I don’t want to move the boxes around; I want to blow them up.” Let me here update what happened after 2010. What happened was the voters put Gov. Jerry Brown back in office. One thing he always was good on, beginning with his first stint in the governor’s chair in the 1970s, was keeping budgets under control. Elected again in 2010, during his eight years in office he made sure the spending/personal income ratio never rose above 5.8 percent. Unfortunately, Gov. Gavin Newsom, taking office in 2019, started out well, but couldn’t resist going back to the old Wilson-Davis-Schwarzenegger overspending. Here are the ratio numbers (the last two are estimated): 2019–20 5.56 2020–21 5.87 2021–22 7.39 2022–23 7.96 2023–24 7.10 Of course, 2022–23 was the year of the nearly $100 billion surplus. Too bad it wasn’t used to reform the state revenue structure to make it less volatile. As the Great Recession hit in 2007 and Schwarzenegger’s box-expanding spending increases couldn’t be sustained, revenues dropped $20 billion in one year, causing $40 billion deficits. Could it happen again? We’ll s

Commentary

Back in 2003, I was perusing some state budget documents and found an interesting correlation. When state general-fund spending rose above 6.2 percent of the income of Californians, inevitably the state would run deficits, get into budget trouble, and end up having to make sharp budget cuts and tax increases.

The data came from Gov. Gray Davis’s January 2003 budget proposal. That’s still how it’s done in Gov. Gavin Newsom’s January 2023 budget proposal, with Schedule 6. Divide the Expenditures/General Fund number by the Expenditures per $100 of Personal Income/General Fund number.

The title of my column in the Orange County Register was “The 6.2 percent solution.” Our great artist Jocelyn Leger drew a nice graph. (The column used to be online, but for some reason no longer is.) The name was a play on Sherlock Holmes’ 7 percent solution of cocaine he was addicted to, and for which he was cured by Sigmund Freud in the 1976 movie, “The Seven-Per-Cent Solution.”

I noted how it was like carrying a burden on your back. If it’s 10 pounds, then for a healthy person it’s no problem. But 20 pounds for many people is pushing it. Put on 50 pounds and you’re slowed down sharply, and many people might not be able to walk more than a few feet before resting, even falling.

A spending burden of 6.2 percent or below is tolerable in California. Above it causes problems.

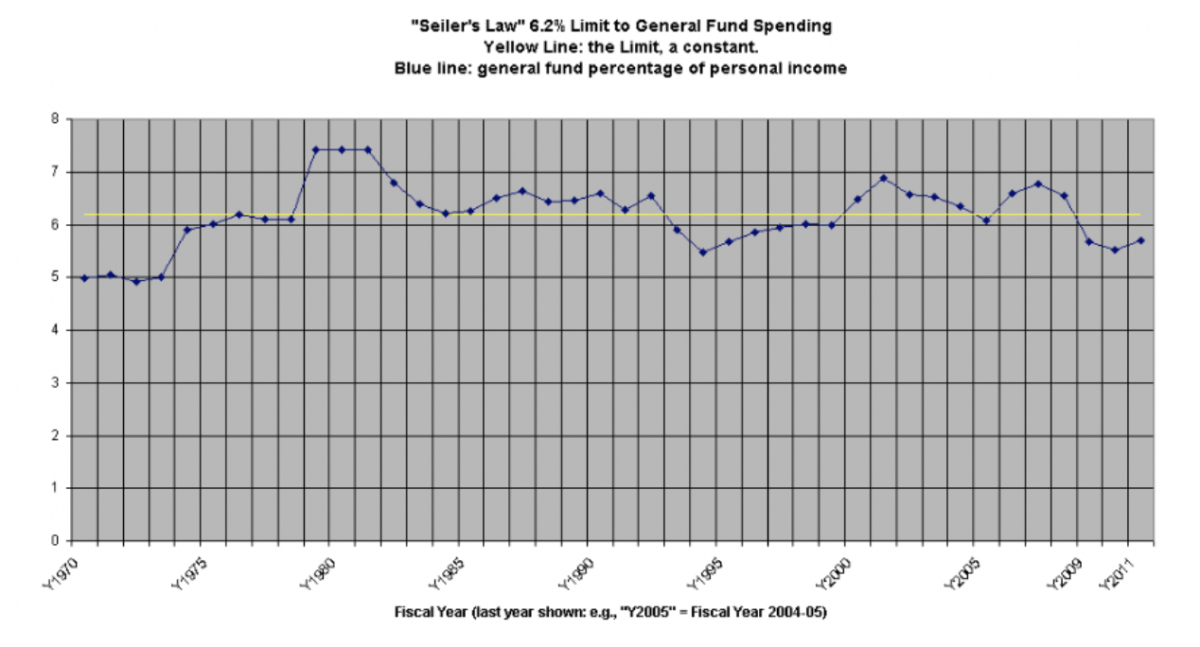

Over the years, I have updated the discovery in different publications. One was on May 27, 2010 in CalWatchDog.com, titled “CA budget tops sensible limits.” It ran this Excel graph, unfortunately not as elegant as Jocelyn’s. I’m a word and numbers guy, not an artist.

As I noted in that 2010 column:

In early 2005, Tom Campbell, then the budget director for Gov. Schwarzenegger … visited us for an editorial board meeting. I showed him the graph.

“That’s Seiler’s Law,” Campbell said. “Like Moore’s Law in computing.” And I’ve kept the name ever since.

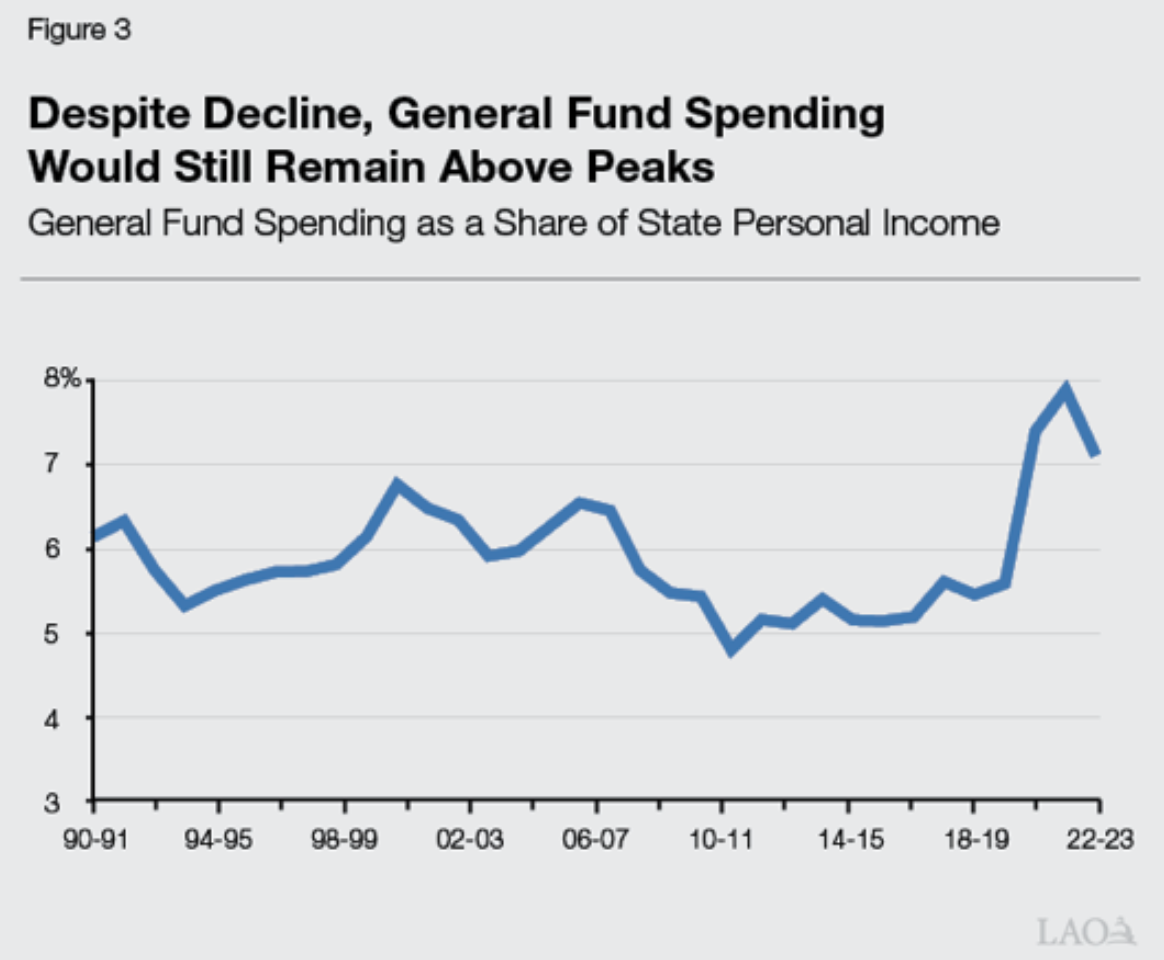

Well, flash forward to 2023, and I was perusing another budget document—I know, it’s an exciting life—“The 2023–24 Budget Multiyear Assessment,” by the California Legislative Analyst (LAO). Lo and behold, I noticed a graph that looked familiar:

Here’s the LAO’s analysis:

Even With Revenue Declines, Spending Remains Above Historically Recent Peaks. Since around 2020, the state has seen historic surges in revenues—and ensuing historically large surpluses and spending levels. However, while revenues are moderating from the recent peak, they are still above average historical levels. For example, even after adjusting for inflation, anticipated revenues for 202324 remain about 20 percent higher than before the pandemic. Moreover, the Governor’s proposed spending level—as a share of the economy shown in Figure 3—remains above peaks from the early and mid2000s. None of these levels—both on the revenue and spending side—are consistent with shortfalls seen during recessions.

They didn’t mention the 6.2 percent limit—Seiler’s Law. But you can see it anyway if you mentally draw a line across the data points at 6.2 percent, as I did in my graph. They also didn’t mention my discovery. Perhaps they didn’t know about it and figured it out on their own, much as Newton and Leibnitz discovered calculus independently.

The Legislative Analyst didn’t provide a detailed analysis. You can read mine in that 2010 article on what happened up to that point. Basically, as you can see from the graphs, the budget went above the 6.2 percent limit in the early 1990s under Republican Gov. Pete Wilson, during the 1999–2000 dot-com boom under Democratic Gov. Gray Davis, then under the wild spending under Republican Gov. Arnold Schwarzenegger in the mid-2000s. Even though he was elected to tame the deficits, and pledged in his January 2004 State of the State address, “Every governor proposes moving boxes around to reorganize government. I don’t want to move the boxes around; I want to blow them up.”

Let me here update what happened after 2010. What happened was the voters put Gov. Jerry Brown back in office. One thing he always was good on, beginning with his first stint in the governor’s chair in the 1970s, was keeping budgets under control. Elected again in 2010, during his eight years in office he made sure the spending/personal income ratio never rose above 5.8 percent.

Unfortunately, Gov. Gavin Newsom, taking office in 2019, started out well, but couldn’t resist going back to the old Wilson-Davis-Schwarzenegger overspending. Here are the ratio numbers (the last two are estimated):

- 2019–20 5.56

- 2020–21 5.87

- 2021–22 7.39

- 2022–23 7.96

- 2023–24 7.10

Of course, 2022–23 was the year of the nearly $100 billion surplus. Too bad it wasn’t used to reform the state revenue structure to make it less volatile.

As the Great Recession hit in 2007 and Schwarzenegger’s box-expanding spending increases couldn’t be sustained, revenues dropped $20 billion in one year, causing $40 billion deficits. Could it happen again? We’ll soon find out.

With the LAO now warning about the 6.2 percent limit, perhaps governors and legislators will be more prudent. Well, maybe.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.