Brazil-China Yuan Trade Deal Not a Game Changer

Commentary According to a statement by the Brazilian government, Brazil and China reached an agreement on March 29 to conduct trade in their own currencies rather than the U.S. dollar. No details have been released on how this will work or if it applies to all trade between the two countries. All that has been made public is that the transactions will be processed by the Industrial and Commercial Bank of China (ICBC) and Brazil’s Bank of Communications (BBM). ICBC will establish a clearing house in Brazil that will allow yuan transactions. Since the reports say that the clearing house will be constructed, it seems these trades are not happening yet. Additionally, no start date has been provided. Beijing is celebrating the agreement as a step toward de-dollarization in the world and as an increase in the internationalization of the yuan. Wang Youming, senior research fellow and director of the Department for Developing Countries Studies at the China Institute of International Studies, told Chinese state-run media Global Times that Washington’s “irresponsible monetary policy, especially continuous interest rate hikes, has led to depreciation of the Brazilian real and increased costs in transactions.” The U.S. dollar has been the world’s reserve currency since the Bretton Woods agreement of 1944. At the end of World War II, the economies of Europe and Asia were in a state of collapse, and their currencies were near worthless. To promote international trade and help the world recover from the war, the United States agreed to back its currency with gold and to back other currencies with U.S. dollars. Even though the United States went off the gold standard in 1971, the dollar remained the global reserve currency because of its stability and convertibility. Another benefit of the dollar was that global commodities, particularly oil, are priced and traded in dollars. Since all countries need oil, it made sense for countries to hold dollars as reserves. And since they were already using dollars for oil and holding dollars in reserves, it was logical for countries to price their goods and pay for imports with dollars. The fact that the U.S. dollar is the world’s reserve and trade currency gives the United Stas tremendous geopolitical power and influence. Some countries, particularly Russia and China, increasingly resent U.S. economic hegemony and have been looking for ways to bypass the dollar. To this end, Beijing has established several workarounds, such as currency swaps or the China International Payment System (CIPS), a SWIFT alternative, which allows international settlement in yuan. So far, 103 countries have joined, although the total volume of trade settlement has been small. In 2016, the yuan was added to the International Monetary Fund (IMF) Special Drawing Rights (SDR), a basket of currencies from which countries can draw when they need liquidity. Although this technically makes the yuan an international currency, the yuan only accounts for 3 percent of global currency reserves, whereas the dollar represents 60 percent and the euro 20 percent. As for trade, roughly 14.7 percent of cross-border trade is settled in yuan. A clerk counts stacks of Chinese yuan and U.S. dollars at a bank in Shanghai, China, on July 22, 2005. (China Photos/Getty Images) For a currency to become a true reserve currency, it must meet five requirements. The first is stability. The degree of control the Chinese Communist Party (CCP) has over the yuan makes its stability somewhat questionable. Additionally, the yuan is loosely pegged to the dollar, so adding yuan to a reserve portfolio of dollars would not represent the same degree of diversification that adding euros or yen would. Second, a currency must be widely accepted. Currently, the U.S. dollar can be used for almost any trade settlement. Among the very few exceptions is North Korea, which demands euros. Liquidity is the third consideration: A currency must be widely exchangeable. Dollars can be exchanged nearly anywhere, which is not quite true of the yuan. However, the yuan arguably meets the fourth and fifth requirements of an international currency, size, and power. A world currency must exist in adequate quantity to support world trade. The Canadian dollar and the Swiss franc are both excellent currencies but lack the scale of the yuan or the U.S. dollar. The final requirement for a global currency is that the country must have significant military and political power. This is true of the United States and increasingly true of China. Aside from a currency matching the definition of a world currency, it must be useful. The British pound and the euro are both international currencies, and yet countries in Asia tend to hold fewer of them because these countries have less use for European currencies. To be useful, a country must be able to transact trade with a currency. China is Brazil’s biggest trading partner, with bilateral trade reaching $172 billion l

Commentary

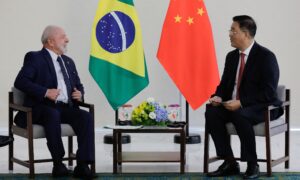

According to a statement by the Brazilian government, Brazil and China reached an agreement on March 29 to conduct trade in their own currencies rather than the U.S. dollar.

No details have been released on how this will work or if it applies to all trade between the two countries. All that has been made public is that the transactions will be processed by the Industrial and Commercial Bank of China (ICBC) and Brazil’s Bank of Communications (BBM).

ICBC will establish a clearing house in Brazil that will allow yuan transactions. Since the reports say that the clearing house will be constructed, it seems these trades are not happening yet. Additionally, no start date has been provided.

Beijing is celebrating the agreement as a step toward de-dollarization in the world and as an increase in the internationalization of the yuan. Wang Youming, senior research fellow and director of the Department for Developing Countries Studies at the China Institute of International Studies, told Chinese state-run media Global Times that Washington’s “irresponsible monetary policy, especially continuous interest rate hikes, has led to depreciation of the Brazilian real and increased costs in transactions.”

The U.S. dollar has been the world’s reserve currency since the Bretton Woods agreement of 1944. At the end of World War II, the economies of Europe and Asia were in a state of collapse, and their currencies were near worthless. To promote international trade and help the world recover from the war, the United States agreed to back its currency with gold and to back other currencies with U.S. dollars.

Even though the United States went off the gold standard in 1971, the dollar remained the global reserve currency because of its stability and convertibility. Another benefit of the dollar was that global commodities, particularly oil, are priced and traded in dollars. Since all countries need oil, it made sense for countries to hold dollars as reserves. And since they were already using dollars for oil and holding dollars in reserves, it was logical for countries to price their goods and pay for imports with dollars.

The fact that the U.S. dollar is the world’s reserve and trade currency gives the United Stas tremendous geopolitical power and influence. Some countries, particularly Russia and China, increasingly resent U.S. economic hegemony and have been looking for ways to bypass the dollar. To this end, Beijing has established several workarounds, such as currency swaps or the China International Payment System (CIPS), a SWIFT alternative, which allows international settlement in yuan. So far, 103 countries have joined, although the total volume of trade settlement has been small.

In 2016, the yuan was added to the International Monetary Fund (IMF) Special Drawing Rights (SDR), a basket of currencies from which countries can draw when they need liquidity. Although this technically makes the yuan an international currency, the yuan only accounts for 3 percent of global currency reserves, whereas the dollar represents 60 percent and the euro 20 percent. As for trade, roughly 14.7 percent of cross-border trade is settled in yuan.

For a currency to become a true reserve currency, it must meet five requirements.

The first is stability. The degree of control the Chinese Communist Party (CCP) has over the yuan makes its stability somewhat questionable. Additionally, the yuan is loosely pegged to the dollar, so adding yuan to a reserve portfolio of dollars would not represent the same degree of diversification that adding euros or yen would.

Second, a currency must be widely accepted. Currently, the U.S. dollar can be used for almost any trade settlement. Among the very few exceptions is North Korea, which demands euros.

Liquidity is the third consideration: A currency must be widely exchangeable. Dollars can be exchanged nearly anywhere, which is not quite true of the yuan.

However, the yuan arguably meets the fourth and fifth requirements of an international currency, size, and power. A world currency must exist in adequate quantity to support world trade. The Canadian dollar and the Swiss franc are both excellent currencies but lack the scale of the yuan or the U.S. dollar.

The final requirement for a global currency is that the country must have significant military and political power. This is true of the United States and increasingly true of China.

Aside from a currency matching the definition of a world currency, it must be useful. The British pound and the euro are both international currencies, and yet countries in Asia tend to hold fewer of them because these countries have less use for European currencies. To be useful, a country must be able to transact trade with a currency. China is Brazil’s biggest trading partner, with bilateral trade reaching $172 billion last year, and this is a plus for the currency deal.

Another use of foreign currency is paying debts. Brazil’s foreign debt stands at $689.87 billion, which must be paid in U.S. dollars. Investment is another reason for holding a country’s currency. While Brazil receives a lot of Chinese investment, Brazilian investment in China is minimal.

Countries also use foreign currency to stabilize their own currency. The Brazilian real was pegged to the dollar until about 20 years ago. As soon as the peg was removed, the currency lost much of its value. Today, the real is free floating (not pegged to any other currency). And finally, countries hold dollars because oil and other commodities are priced in dollars.

China and Brazil have been looking for ways to bypass the dollar. This latest agreement is a step in that direction, but the yuan does not meet several requirements to function as a reserve currency. Therefore, it is possible that the two countries will agree to conduct some of their trade in yuan but not all of it, and neither country can afford to dump the dollar completely.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.